I’m not an economist. Fortunately, you don’t need to study economics to form an opinion. You can get them at the opinion store. There are scads of economists of all stripes sitting around in bloviation tanks, and you can just pick one out like a lobster. They’re like scriptures: you can find one to match any position you might want to take.

Usually, when people form opinions without the benefit of sound scientific knowledge, bad results happen. I make an exception for the science of economics. I will freely admit I have no idea how the economy works; this is the main difference between me and most economists. But I do have eyeballs, and time-in, and have made several observations.

Even in very small societies, people quickly discover they are better off if they band together for some things. In very large ones, it’s the only way to fly. We need to transport goods to market, punish miscreants, and make sure our poop has somewhere to go. We all need to chip in to see these things done. Reasonable people can disagree on what and how much should be done. Many people think the government goes too far in providing things, and they make good points. I think access to adequate health care should be provided for all, and I think we might economize a bit by reducing the amount of wherewithal available for the country to bomb the living crap out of another country. I think this would make us safer, too. That’s just my opinion–you might draw the lines elsewhere.

But whatever it is we agree to go in on together, taxes are how we pay for them. Who pays them, and how much they are dinged, is the subject of much discussion these days. Some people think the rich are the last people who should be asked to pony up. I disagree, and not just because they’re the ones with the money, although I wouldn’t look for olives on a walnut tree. I think it comes down to fairness.

Some people believe a flat tax is the most fair, because everyone pays the same percentage of their income. I disagree, because I believe it is the sacrifice that people make that needs to be evened up, not the percentage. Let’s see how this works by using the arbitrary but easily-calculated tax rate of 50% as an example. A man making $20,000 a year is really going to feel a $10,000 tax. But I would imagine one lives just about the same on a billion dollars as a half a billion dollars. I don’t think I could even tell the difference. I also think that those who could tell the difference should not be considered moral arbiters.

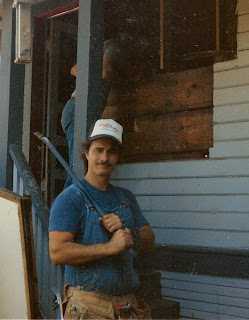

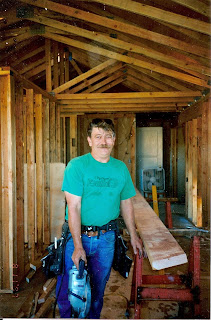

You hear claims that wealthy people have earned their money. Some have, and others haven’t done a damn thing for it. And there is a certain amount of money I don’t think it is possible to earn, not in a moral sense. I don’t care to listen to anyone farting through silk who thinks he’s worked hard for his money, not when I’ve watched my husband come home for 35 years shredded, sliced up, and, on some occasions, on fire. In fact, above a certain level of income, I’m all for a 90% rate. If you can’t live as well on a hundred million dollars as you can on a billion, you need to work on your priorities. You may have problems, but they’re not ones I should have to subsidize. Because that is what we are doing. Whatever we decided to pay for as a society–missiles and healthcare, or just basic cable and donuts on Fridays–we need to come up with a way of paying for it, and if the lucky sperm club shouldn’t be asked to contribute, then the rest of us have to. If you are so fortunate that your own money is making all your money, why should that be exempt from taxation when the meager earnings of the single mom holding down two crappy jobs isn’t?

The current theory is that the rich people should not be inconvenienced by the demands of comity because they’re the ones who are providing jobs for the rest of us. Those jobs should be kicking in any time now, because we lowered the taxes on the rich people several years ago. There should be so many jobs by now that they’re just loitering in gangs, making nuisances of themselves.

In fact, very wealthy people and corporations have created gobs of jobs in the last few decades. Unfortunately for us, they’re in China, where most of our manufacturing jobs went. People work for way less money and no benefits and no one whines about the pollution. What’s not to love? A dangerously obese corporation called Walmart got the ball rolling by going Godzilla on our economy. It was a win-win for Walmart. They got everything made a lot cheaper, and destroyed entire manufacturing towns here, the factory workers and the diners and ma-and-pa stores they shopped at, until no one could afford to shop anywhere but Walmart. People who invested in Walmart did really well. Even better, because they don’t have to pay as much tax on their “earnings” as the people who have to haul their carcasses out of bed to go to work do.

In fact, very wealthy people and corporations have created gobs of jobs in the last few decades. Unfortunately for us, they’re in China, where most of our manufacturing jobs went. People work for way less money and no benefits and no one whines about the pollution. What’s not to love? A dangerously obese corporation called Walmart got the ball rolling by going Godzilla on our economy. It was a win-win for Walmart. They got everything made a lot cheaper, and destroyed entire manufacturing towns here, the factory workers and the diners and ma-and-pa stores they shopped at, until no one could afford to shop anywhere but Walmart. People who invested in Walmart did really well. Even better, because they don’t have to pay as much tax on their “earnings” as the people who have to haul their carcasses out of bed to go to work do.

The next time you hear some politician railing about “job-killing taxes,” haul him back to relevance by finding out where he stands on rewarding companies that send jobs overseas. It’s sort of like the people who don’t want gays to marry (they mean “exist”) because it harms the institution of marriage. Are they working hard to criminalize divorce? No? Huh.

Rhetoric on estate taxes is equally revealing. Now it’s being called the “death tax,” and the claim is made that “they even tax us when we die.” Well, no. You’re dead. Your tax-paying days are over. The people who claim to be upset that they’re taxed when they die won’t even need any more money where they’re going. Heat is provided by the management.

It’s Junior, who just got a slab of money landing on his head, and who may or may not be a worthy contributing member of society, who is being taxed. Not on what he’s earned, but on the slab that just fell on his head. If you think it’s unfair for him to pay taxes on that money, you’re saying it’s more fair to take it out of the hide of the woman who cleans his house. Pardon me for calling this an immoral position.

It’s Junior, who just got a slab of money landing on his head, and who may or may not be a worthy contributing member of society, who is being taxed. Not on what he’s earned, but on the slab that just fell on his head. If you think it’s unfair for him to pay taxes on that money, you’re saying it’s more fair to take it out of the hide of the woman who cleans his house. Pardon me for calling this an immoral position.

I guess we could go ahead and cut taxes on everybody. But don’t blame me if your poop doesn’t go where you want it to.

Great post. I hate Walmart. Also huge impersonal bookstore chains.

I'm arithmetically dyslexic, but wouldn't around 50% of politicians with this philosophy make a bigger than 50% difference?

(And if not, the sewer line could be re-routed!)

// Are they working hard to criminalize divorce? No? Huh.//

I like that. What happened to me in my divorce was criminal.

WalNart sucks bad sardines… I will not set foot in one. they run all the small shops out of business… then, if in ten years or so, a store location is not provitable, they close that store in a small town and, in essence, leave that town screwed. I now have no alternative but to go to a big box store for socks underwear and blue jeans. If Congress really wanted to help 'small business' they would outlaw WalNart. Gosh… no I am all upset.

You hear claims that wealthy people have earned their money. Some have, and others haven't done a damn thing for it.

If income reflected the value of the contribution people make, then medical researchers would be taking home the seven-figure bonuses, and Wall Street manipulators would be panhandling.

All I can say is "Amen!"

There should be a law that the highest earners in a company can't be paid more than a certain multiple of the lowest earners' wages. Like a factor of twenty. Then either they'd have to limit their own salaries or increase everyone else's.

The people at the top don't "earn" their million dollar salaries. They just steal it from the rest of us.

I'll drive 25 minutes to the nearest town with decent shopping before I will shop at the local Walmart. and as far as the rich are concerned? tax the shit out of them whether they earned it or not. if you've got more money than you can spend then you don't need it.

Hear, hear! I guess I don't have to ask you what you think about the Republican platform. You just said it all, right here. For me, you are preaching to the choir. At least you do it with humor, thank you for that!

Shoot, my clever comment didn't take. It was witty and incisive and full of telling detail, too.

But my point was that you don't even *start* paying U.S. inheritance taxes, until you've raked in five million. You get five million tax free. If your family farm is worth more than that, don't bother to cue the violins over your terrible tax burden, not on my account. Just sell a few hundred cows, huh?

Nick: There used to be an unwritten law in Japan that the highest paid person (ie the boss) wouldn't be paid more than a small multiple (I seem to recall about 15x) of what the shop floor guy was paid. It worked just fine. My reference is Ezra Vogel's "Japan as Number One," a book out some years ago before Japan had its own little problems. Worth a look.

Murr: Take a wikipedia look at the GINI Index, a measure of inequality in nations. Ours has been rising, which is NOT good. Last time was in the 1920's…

Letting the GINI out of the bottle isn't good for ANY society.

As we say in West Virginia, you are "RAT OWN!"

I heard a TV news man say one time that … if you took all the economist in the world and laid them end-to-end, they would all point in different directions.

I hear Alan Greenspan wanders around mumbling Oh shit, I was reading that upside-down. That's OK, he's leaving his billions in the bank in Bimini and drawing her Social Security instead.

I think the future in jobs will be in Undertaking. Hell, won't be long before they won't be able to keep up with demand!

I won't shop at VoldeMart. Used to try hard to buy Canadian, but it's almost impossible to find something that is made here now. Can't even find "Made in the US"! It REALLY burns me that all the garlic in the supermarkets comes from China. What, we can't grow our own flipping garlic?

It's Commies like you who are bent on dismantling our economy and destroying the rich folks' will to live. Shame on you!

You're a communist, that's what you are. If we start outlawing billionaires, then only outlaws will have billions of dollars. God Bless America, where everyone can dream of getting rich and powerful, even if only 1 percent of them actually make it!

I have herd it say that government coffers overflow when taxes are cut. The only logical response would be to eliminate taxes altogether. Governments would then, somehow, have more money than they knew what to do with. They could then give us huge rebates on the taxes that we wouldn't be paying.

This is one of the better economic treatises on economics that I have come across. Where were you when I was trying to unscramble that supply-demand curve?

You nailed this one brilliantly. I hope you'll send it to the editor of the NYTimes. What the hell. It couldn't hurt and it's certainly as good as anything Krugman's writing (and I'm a big fan of Krugman.)

Outstanding job, my friend. I'll be s haring this everywhere.

(And please consider getting Disqus on your blog. Just a thought. 🙂 )

Brilliant. Thanks for putting it so perfectly.

An aside to Moreidlethoughts: Every time I looked at "arithmetically dyslexic," I couldn't pronounce it. IN MY HEAD. That's sad. I haven't tried it out loud yet.

All these accusations about me being a communist made me remember. "Commie" was the bad word kids called each other when I was little. I'm thinking that was replaced by "terrorist?"

NY Times doesn't accept things already published, and I don't know if this counts. But I'll ask. Thanks. I've thought about putting in Diqus but I'm afraid my site will blow up, which is what it does when I tinker. Maybe I'll let you waltz me through it, Jayne. Thanks, everybody. Do I have any wealthy followers? (If so, contact me privately. We'll tawk.)

Well, Disqus, not Diqus. See? Already.

Sing it sistah!

I love Paul Krugman too. I guess that makes you Murrugman.

Very nicely said!

Absolutely brilliant! I think I love you.

I thought I felt something, there.

I didn't quite get economics when I studied it. Too much macro and micro stuff. Liked the cool supply and demand curves though, they were swish. But it will be interesting to see how the approach taken in the UK will work. Cutting back public sector spend will take money out of the economy and stop little people like me spending on private sector goods. How will it work then??

Darn! Just typed a fairly long comment on this gem of a column, but it vanished when I tried to preview. Trying again (but shorter version).

Fave line (despite lots of competition): "They're like scriptures: you can find one to match any position you might want to take."

As for WalMart, I'm not singing their praises, but I'm not a WalMart basher either. I think they've become a too-easy scapegoat for a laundry list of problems that irritate the hell out of most people (my opinion on this is cancelled out by my wife who hates them – so we're not patronizing them anyway).

And just so you don't think I've gone over to the Dark Side, I'm all for higher taxes for the wealthy.

P.S. Thanks for keeping these Portland dispatches coming.

Forgot to add that you killed 2 birds with 1 stone on that fave line above!

Murr, it's much easier to say "arithmetically dyslexic" when you've imbibed a little. Or a lot!You may lisp.

Thank you, Murr for one hilarious, well-written post on a topic that enrages me. Greed is a scary thing – and when you've got more money than you could ever spend and you're not using a dollar of it to make the world a better place, then it's a sin. I'm always amazed to see the wealthy living in conspicuous consumption, completely unaware that the people who serve them are so conspicuously without.

I am adamantly opposed to the WalMartization of North America but you said it much better! And I am mighty tired of the millions who insist on their right to cheap goods -who "know the price of everything and the value of nothing."

I'm new to your space, Murr. I'm impressed by all you've said here and I agree with you totally – I think! I can't understand why world economics are so complex when it should all be so simple. The way you've just layed it all out is logical and fair. I read a lot about the USA (I've also visited many times) and I simply can't grasp the healthcare system (abuse is a better word), the tax system (outright robbery of the hard-working people, sort of Robing Hood in reverse) or even the politics. Well, the whole world has turned upside down, these years. My parents taught me to save, they were ecologically minded without even knowing the word 'ecology', and this worked fine for me until now. I'm a saver whose been robbed of her savings! And I'm no Spring chicken…

OK, I won't weep and wail, but I do want to thank you for the enlightening aspects of your entry. I feel I'm not quite mad, after all!

Greetings from Buenos Aires!

PS: My blog has a lot of Spanish stuff, but I also include English info, so you'll always be welcome to drop a comment in your language where appropriate. I know I shall learn from you… :-))

I'm glad to make your acquaintance, Sylvia. We don't understand any of it, either.

Love this! I, too, wonder if any wealthy people read this as well and what they think.

Brilliant! And simply enough explained that even a Congressperson should be able to understand it. Geeze…what is wrong with this country? I know…it's greed.

"I will freely admit I have no idea how the economy works; this is the main difference between me and most economists".

Don't give them any credit; they don't have a friggin' clue.

I like paying taxes in Canada. First it means I made enough money to pay taxes and second, we get pretty good value for them all things considered. I read that American value for tax-dollar is pretty low on the scale which may account for the dissatisfaction of paying in the USA. It is more like Europe in the centuries prior to the last one. Taxes supported the nobility and military adventures.

"I will freely admit I have no idea how the economy works; this is the main difference between me and most economists".

Don't give them any credit; they don't have a friggin' clue.

I like paying taxes in Canada. First it means I made enough money to pay taxes and second, we get pretty good value for them all things considered. I read that American value for tax-dollar is pretty low on the scale which may account for the dissatisfaction of paying in the USA. It is more like Europe in the centuries prior to the last one. Taxes supported the nobility and military adventures.

Brilliant! And simply enough explained that even a Congressperson should be able to understand it. Geeze…what is wrong with this country? I know…it's greed.

I am adamantly opposed to the WalMartization of North America but you said it much better! And I am mighty tired of the millions who insist on their right to cheap goods -who "know the price of everything and the value of nothing."

Well, Disqus, not Diqus. See? Already.

This is one of the better economic treatises on economics that I have come across. Where were you when I was trying to unscramble that supply-demand curve?

It's Commies like you who are bent on dismantling our economy and destroying the rich folks' will to live. Shame on you!

Murr: Take a wikipedia look at the GINI Index, a measure of inequality in nations. Ours has been rising, which is NOT good. Last time was in the 1920's…

Letting the GINI out of the bottle isn't good for ANY society.

As we say in West Virginia, you are "RAT OWN!"

Shoot, my clever comment didn't take. It was witty and incisive and full of telling detail, too.

But my point was that you don't even *start* paying U.S. inheritance taxes, until you've raked in five million. You get five million tax free. If your family farm is worth more than that, don't bother to cue the violins over your terrible tax burden, not on my account. Just sell a few hundred cows, huh?

Hear, hear! I guess I don't have to ask you what you think about the Republican platform. You just said it all, right here. For me, you are preaching to the choir. At least you do it with humor, thank you for that!

There should be a law that the highest earners in a company can't be paid more than a certain multiple of the lowest earners' wages. Like a factor of twenty. Then either they'd have to limit their own salaries or increase everyone else's.

The people at the top don't "earn" their million dollar salaries. They just steal it from the rest of us.

// Are they working hard to criminalize divorce? No? Huh.//

I like that. What happened to me in my divorce was criminal.

WalNart sucks bad sardines… I will not set foot in one. they run all the small shops out of business… then, if in ten years or so, a store location is not provitable, they close that store in a small town and, in essence, leave that town screwed. I now have no alternative but to go to a big box store for socks underwear and blue jeans. If Congress really wanted to help 'small business' they would outlaw WalNart. Gosh… no I am all upset.

Great post. I hate Walmart. Also huge impersonal bookstore chains.